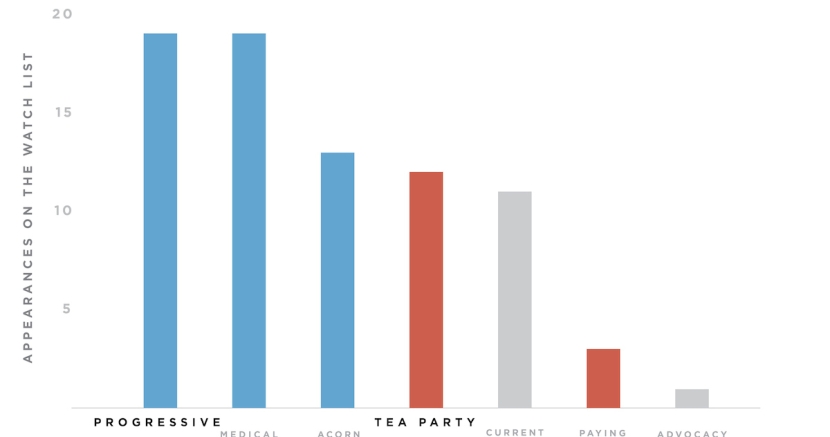

Finally, on April 23, 2014, an open records request revealed that progressive groups were targeted more extensively than Tea Party groups. (Source: Think Progress)

- Following Citizens United, the number of groups seeking tax-exempt status for their 501(c)4 nonprofit more than doubled - from 1,591 to 3,398

- 296 groups received additional scrutiny from the IRS, and two-thirds of those groups appear to not be conservative - including Progress Texas

- To date, no Tea Party group has been denied tax-exempt status

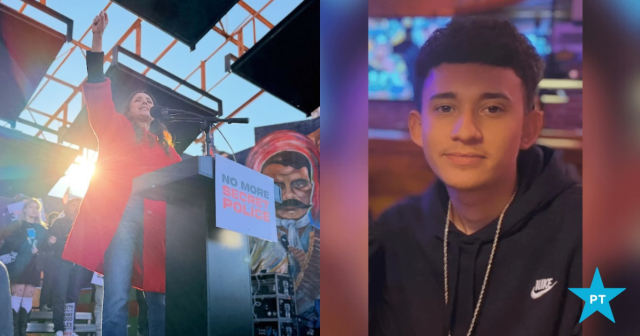

How is Progress Texas Involved?

When we applied for tax-exempt status for our 501(c)4, Progress Texas received the same type of additional vetting that Tea Party groups are complaining about. We accept this vetting process and we've abided by it. We all play by the same rules, and Tea Party groups should not be exempt from the rules that apply to every other organization. We have written previously about the matter here:

- Should the Tea Party Be Exempt from Playing By Their Own Rules?

- Tea Party: Hire More IRS Employees

- The Tea Party Should Have to Play By the Same Rules

The IRS sent Progress Texas a similar letter it sent various Tea Party organizations. The letter contained many of the 7 controversial questions that the IRS Inspector General report identified as worrisome, based on news reports.

- IRS March 2011 Letter - Notification of receipt of our tax-exempt request form

- IRS Request for More Information - Sent Feb. 22, 2012

- IRS Confirmation of Tax-Exempt Status - Received Jun. 15, 2012

Sample of News Coverage on the Tea Party IRS "Controversy" - Emphasis Added

The Internal Revenue Service’s screening of groups seeking tax-exempt status was broader and lasted longer than has been previously disclosed, the new head of the agency acknowledged Monday. Terms including ‘‘Israel,’’ ‘'Progressive’’ and ‘‘Occupy’’ were used by agency workers to help pick groups for closer examination, according to an internal IRS document obtained by The Associated Press.

Close to a third of the advocacy groups named by the Internal Revenue Service as recipients of special scrutiny during tax-exempt application reviews were liberal or neutral in political outlook, a leading nonpartisan tax newsletterreported after conducting an independent analysis of data released by the agency.

When CVFC, a conservative veterans’ group in California, applied for tax-exempt status with the Internal Revenue Service, its biggest expenditure that year was several thousand dollars in radio ads backing a Republican candidate for Congress.The Wetumpka Tea Party, from Alabama, sponsored training for a get-out-the-vote initiative dedicated to the “defeat of President Barack Obama” while the I.R.S. was weighing its application.[...]A close examination of these groups and others reveals an array of election activities that tax experts and former I.R.S. officials said would provide a legitimate basis for flagging them for closer review.

NPR (May 19, 2013) - Nonconservative Groups Say IRS Scrutinized Them, Too

Another application that seemingly got caught up in the backlog came from a group of journalists in Chicago. The Chicago News Cooperative provided news for the Midwest edition of The New York Times. The co-op also sought tax-exempt status. Veteran journalist James O'Shea, a former managing editor of The Chicago Tribune, was in charge.

"There were political organizations trying to get these exemptions, and I think the IRS was concerned — and probably appropriately so — that some of these news organizations were really political organizations," he says, "and so they were examining that, and we just got caught up in that."

Austin-based Progress Texas tells CNN it received an IRS questionnaire similar to those sent to Tea Party groups.

Bloomberg (May 14, 2013) - IRS Sent Same Letter to Democrats That Fed Tea Party Row:

The Internal Revenue Service, under pressure after admitting it targeted anti-tax Tea Party groups for scrutiny in recent years, also had its eye on at least three Democratic-leaning organizations seeking nonprofit status. One of those groups, Emerge America, saw its tax-exempt status denied, forcing it to disclose its donors and pay some taxes. None of the Republican groups have said their applications were rejected.

Grant wrote that "centralization was warranted" because many of the applications the IRS began to receive in 2010 "were in many cases vague as to the activities the applicants planned to conduct."For example, a number of applications indicated that the organization did not plan to conduct political campaign activity, but elsewhere described activities that appeared in fact to be such activity."

DONATE

Your donation supports our media and helps us keep it free of ads and paywalls.