Should the Tea Party Be Exempt From Playing by the Rules?

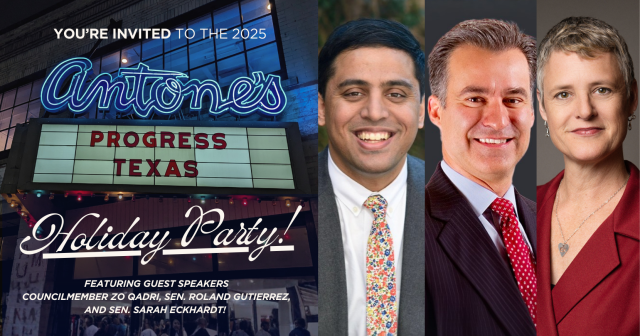

The IRS sent our organization, Progress Texas, the same a similar* letter it sent various Tea Party organizations that you're reading about in the news. A couple of quick notes:

- While the IRS was screening Tea Party groups, the agency was headed by Doug Shulman - a George W. Bush appointee

- Many Tea Party groups operate like political PACs or political parties - which is not allowed under law

- It took us at Progress Texas 479 days to have our tax-exempt status approved, and we support the due diligence

Below is a statement from Ed Espinoza, our Executive Director, on this story:

Progress Texas and the Tea Party strongly disagree on the role of government. Yet, when we applied for tax-exempt status, Progress Texas received the same type of additional scrutiny that Tea Party groups are complaining about. The similar treatment indicates the IRS was likely addressing a flood of 501c4 applications after Citizens United, and undermines the paranoid notion that Tea Party groups were singled out.

Below are the documents we received from the IRS in the process of our request.

- IRS March 2011 Letter - Notification of receipt of our tax-exempt request form

- IRS Request for More Information - Sent Feb. 22, 2012

- IRS Confirmation of Tax-Exempt Status - Received Jun. 15, 2012. This letter also contains notice that the effective date of our exemption was February 22, 2011

*Corrected - though we received the same type of scrutiny, our letter was different. Headline also updated on 5/16/13.

DONATE

Your donation supports our media and helps us keep it free of ads and paywalls.