Tax Day has come and gone, and for most Texans, that means you know you’ve paid your fair share of taxes. That is, unless you’re Governor Greg Abbott. The Dallas Morning News reports Gov. Abbott made $134,000 last year, but only paid $104 in federal income taxes.

So Gov. Abbott, with an estimated personal wealth well beyond his state salary that puts him squarely in the top 1%, paid a tax rate of less than 1% in 2014.

Gov. Greg Abbott released his 2014 income taxes on Friday, revealing that because of capital gain losses and other deductions that he paid a federal tax rate of only .07 percent.

Abbott and his wife Cecilia earned a gross income of $134,000, almost exclusively from his state salary as then-attorney general.

But because of losses from investments and large deductions, the Abbotts paid $104 total in federal income taxes. They are due a refund of $19,390.

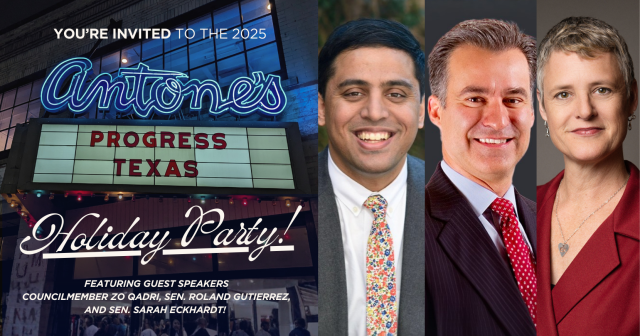

DONATE

Your donation supports our media and helps us keep it free of ads and paywalls.